What is the concept of investment vs speculation?

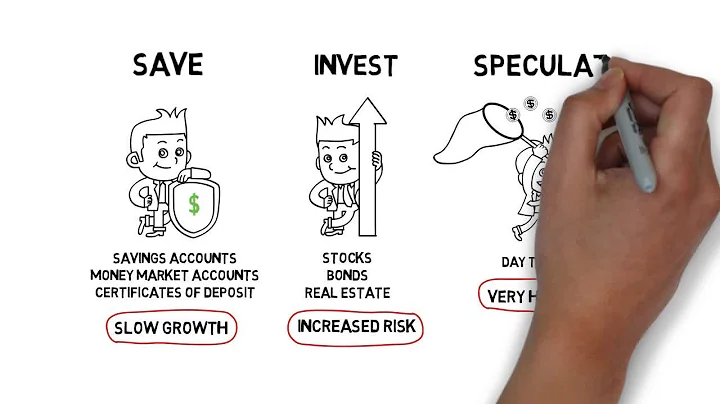

At its core, investing is about buying assets that have a reasonable expectation of generating a return over time, while speculation is more about taking risks in the hopes of making a quick profit.

Speculations are quick ways to get results, but these results can be unpredictable. Investment takes longer periods to show results. Gambling, momentum investing, growth stocks, foreign currencies, cryptocurrencies. Stock market, savings accounts, Government securities, value investing, mutual funds, etc.

Speculation (also known as speculative trading) is a financial term that refers to the act of purchasing an asset (a commodity, good or real estate) that has a substantial risk of losing value but also holds the hope of gaining value in the near future.

-Investing entails putting your money in an asset that generates a return. Examples: real estate, stocks, and bonds. - Speculating generates returns entirely from supply and demand. Examples: comic books, coins, art, futures, options, and gems.

Ben Graham defined an investment operation as one which, on thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.

Speculation can involve any tradeable good or asset – a key difference from investing, where decisions are generally based on research and fundamental analysis, such as business performance metrics.

Examples of speculation in a Sentence

He dismissed their theories as mere speculation. The book is just a lot of idle speculation about the future. Her speculations leave many questions unanswered. He lost everything in foolish land speculation.

Example – A company invests in a tech startup's shares, hoping to sell them for a profit in the short term. It may not be interested in holding the shares for the long term but on speculation that the share values will go up, given the company's positive earnings reports.

An investment is an asset or item acquired with the goal of generating income or appreciation. Appreciation refers to an increase in the value of an asset over time. When an individual purchases a good as an investment, the intent is not to consume the good but rather to use it in the future to create wealth.

Speculation involves investing in assets with the hope of big gains but the chance for a major loss. Investors can speculate on their positions when they make investments in a variety of assets, including stocks, real estate, and other risky ventures.

What is the difference between investment and speculation Quora?

Investment is the act of allocating resources with the expectation of generating an income or profit, while speculation involves taking on a high-risk financial transaction in hopes of making a quick profit.

Objective: Hedging aims to manage and mitigate risk, while speculation focuses on generating profits from market movements. Risk Management vs. Profit-seeking: Hedging strategies prioritize risk management and protection against potential losses, while speculation strategies prioritize potential gains.

In Security Analysis, he proposed a clear definition of investment that was distinguished from what he deemed speculation. It read, "An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative."

Graham pushed the idea of buying stocks at a discount from their intrinsic value. He named the discount the "margin of safety" and considered it an important protective measure. If the stock were already undervalued, it would be less likely to experience major declines.

Low-priced securities often are considered speculative investments, which you should only make with money that you can afford to lose. They tend to be volatile, and they trade in low volumes, which means they're subject to price fluctuations from even relatively small trades.

Speculators tend to put money into assets with volatile prices. They hope to profit significantly by buying on the downswing and selling on the upswing. Their acceptable risk level is high. Investors, on the other hand, tend to put money into assets promising stable, modest appreciation with limited downside risk.

Disadvantages of Speculation

It means that speculation may lead to price fluctuations that, even though they are merely temporary, can have a long-term impact on the fortunes and stability of a company, an industry, or even a whole economy.

Gambling refers to wagering money in an event that has an uncertain outcome in hopes of winning more money, whereas speculation involves taking a calculated risk with an uncertain outcome. Speculation involves some sort of positive expected return on investment—even though the end result may very well be a loss.

The concept of the "safest investment" can vary depending on individual perspectives and economic contexts, but generally, cash and government bonds, particularly U.S. Treasury securities, are often considered among the safest investment options available. This is because there is minimal risk of loss.

The most common example is bonds, which come in various forms, including corporate and government, whether local, state or federal. Some fixed-income securities have equity-like characteristics, such as convertible bonds. Cash and cash equivalents comprise a third type of investments.

Is real estate a speculative investment?

Non-Speculative Investment

It is a productive asset, which is something that produces income for you while you own it. In turn, you do not need to sell it for it to be a great investment. Real Estate, farming, and owning a portion of a business are some kinds of non-speculative investments.

Speculators are seeking to make abnormally high returns from bets that can go one way or the other. Speculative traders often utilize futures, options, and short selling trading strategies.

The three types of investors in a business are pre-investors, passive investors, and active investors.

Safety, income, and capital gains are the big three objectives of investing but there are others that should be kept in mind as well.

Speculation (assuming that you either don't have any proofs for your claims or they're poorly backed up) is known as a counterfactual fallacy, which can also be called a speculative fallacy and hypothesis contrary to fact.

References

- https://www.investopedia.com/investing/steps-successful-investment-journey/

- https://smartasset.com/investing/speculator

- https://talkmarkets.com/content/how-much-money-do-i-need-to-invest-to-make-3000-a-month?post=431352

- https://www.investopedia.com/terms/i/investment-multiplier.asp

- https://fastercapital.com/startup-topic/Factors-to-Consider-in-a-Portfolio.html

- https://www.linkedin.com/company/capital-investment-companies

- https://www.fool.com/investing/how-to-invest/stocks/transferring-stock-after-death/

- https://www.linkedin.com/pulse/macroeconomics-interest-rate-investment-ashish-agarwal

- https://www.mdpi.com/2079-8954/11/3/146

- https://www.rocklandtrust.com/wealth--investments/setting-financial-and-investment-goals

- https://www.experian.com/blogs/ask-experian/how-to-choose-investment-strategy/

- https://byjus.com/commerce/investment/

- https://www.linkedin.com/pulse/investing-vs-speculation-john-ntende

- https://quizlet.com/348073062/chapter-12-flash-cards/

- https://open.lib.umn.edu/principleseconomics/chapter/29-3-investment-and-the-economy/

- https://www.maxlifeinsurance.com/blog/investments/what-is-investment

- https://russellinvestments.com/-/media/files/nz/insights/four-golden-rules-of-active-management-game.pdf

- https://www.investopedia.com/terms/i/invested-capital.asp

- https://www.tataaia.com/blogs/financial-planning/5-important-steps-of-the-investment-process.html

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/speculation/

- https://www.econlib.org/library/Enc/Investment.html

- https://www.empathy.com/property-assets/when-a-business-owner-dies

- https://www.shiksha.com/online-courses/articles/difference-between-investment-and-speculation/

- https://testbook.com/key-differences/difference-between-hedging-and-speculation

- https://www.investopedia.com/ask/answers/021615/what-safest-investment.asp

- https://cleartax.in/glossary/speculation

- https://www.bbvaspark.com/contenido/en/news/what-capital-investment-how/

- https://www.icicibank.com/blogs/mutual-fund/claim-mutual-fund-investment-after-death

- https://www.investopedia.com/terms/i/investing.asp

- https://russellinvestments.com/-/media/files/nz/blog/2020/06/10-golden-rules-of-investing.pdf

- https://www.investopedia.com/insights/forces-behind-interest-rates/

- https://economictimes.indiatimes.com/definition/risk-averse

- https://www.nerdwallet.com/article/investing/most-expensive-stocks

- https://quizlet.com/283489981/unit-7-concepts-flash-cards/

- https://homework.study.com/explanation/the-components-of-a-capital-investment-s-decision-are-a-determining-if-the-investment-is-worthwhile-b-costs-of-investing-c-determining-how-to-finance-the-investment-d-both-a-and-c.html

- https://www.investopedia.com/terms/c/capital-investment-factors.asp

- https://smartasset.com/investing/whats-a-good-return-on-investment-roi

- https://www.investopedia.com/financial-edge/0113/how-to-save-to-start-an-investment-portfolio.aspx

- https://www.bankrate.com/investing/what-is-speculation/

- https://www.iciciprulife.com/investments/investment-process.html

- https://www.csus.edu/indiv/p/pforsichh/documents/lanen3eappendixtext.pdf

- https://www.hdfclife.com/insurance-knowledge-centre/investment-for-future-planning/what-is-investment

- https://www.investopedia.com/terms/p/portfolio-investment.asp

- https://builtin.com/investments-exits

- https://www.investopedia.com/terms/c/capitalrisk.asp

- https://www.investopedia.com/articles/financial-theory/11/6-lessons-top-6-investors.asp

- https://thebudgetnista.com/what-is-the-golden-rule-of-saving-money/

- https://www.truehold.com/post/how-to-make-an-investment-plan

- https://link.springer.com/content/pdf/10.1007/978-1-4899-6880-7_12.pdf

- https://investmentinsight0.medium.com/investment-vs-capital-understanding-the-differences-and-importance-9d0b37975941

- https://www.investopedia.com/terms/i/investment.asp

- https://homework.study.com/explanation/when-choosing-an-investment-you-should-consider-risk-the-four-primary-risk-components-are-a-business-failure-inflation-buying-power-stock-b-buying-power-inflation-interest-rate-market-c-inflation-interest-rate-business-failure-market-d-m.html

- https://fortune.com/recommends/banking/saving-vs-investing/

- https://groww.in/blog/factors-affecting-mutual-funds-investment-decisions

- https://www.bankrate.com/investing/low-risk-investments/

- https://smartasset.com/investing/types-of-investment

- https://www.cnn.com/cnn-underscored/money/investing-for-beginners

- https://en.wikipedia.org/wiki/Investment_(macroeconomics)

- https://www.investopedia.com/managing-wealth/basic-investment-objectives/

- https://www.merriam-webster.com/dictionary/speculation

- https://quizlet.com/106934878/economics-investment-flash-cards/

- https://quizlet.com/137878216/economics-chapter-11-flash-cards/

- https://www.investopedia.com/articles/basics/12/art-of-speculation.asp

- https://www.fool.com/knowledge-center/what-factors-affect-individual-investment-choices.aspx

- https://corporatefinanceinstitute.com/resources/career/buy-side-vs-sell-side/

- https://classic.austlii.edu.au/au/legis/nsw/consol_act/ina2011253/s4.html

- https://www.investopedia.com/financial-edge/0312/how-to-invest-if-youre-broke.aspx

- https://www.wellsfargo.com/goals-investing/why-invest/

- https://www.experian.com/blogs/ask-experian/what-happens-to-bank-account-when-you-die/

- https://www.investopedia.com/terms/c/capital-investment-analysis.asp

- https://quizlet.com/551090968/exam-4-flash-cards/

- https://happay.com/blog/capital-investment/

- https://www.capitaleconomics.com/

- https://www.linkedin.com/pulse/warren-buffetts-5-golden-rules-your-blueprint-investment-brad-wiens-64fhc

- https://www.investopedia.com/financial-edge/0210/rules-that-warren-buffett-lives-by.aspx

- https://www.disnat.com/en/learning/trading-basics/stock-basics/what-causes-stock-prices-to-change

- https://www.investopedia.com/ask/answers/09/difference-between-investing-speculating.asp

- https://www.edwardjones.com/us-en/market-news-insights/personal-finance/investment-strategies/how-start-investment-portfolio

- https://www.finra.org/investors/insights/low-priced-stocks-big-problems

- https://www.citizensadvice.org.uk/family/death-and-wills/dealing-with-the-financial-affairs-of-someone-who-has-died/

- https://www.investopedia.com/ask/answers/042715/what-difference-between-speculation-and-gambling.asp

- https://www.investopedia.com/terms/i/inherited-stock.asp

- https://www.rba.gov.au/publications/rdp/1994/pdf/rdp9402.pdf

- https://policy.trade.ec.europa.eu/help-exporters-and-importers/accessing-markets/investment_en

- https://appreciatewealth.com/blog/six-approaches-for-mitigating-investment-risks-in-the-stock-market

- https://www.fool.com/investing/how-to-invest/famous-investors/benjamin-graham/

- https://medium.com/@Levente22/7-proven-ways-to-make-5-000-9-000-per-month-in-passive-income-1aafbf025154

- https://www.linkedin.com/pulse/short-term-vs-long-term-investment-goals-which-should-vimal-solanki

- https://corporatefinanceinstitute.com/resources/accounting/return-on-investment-roi-formula/

- https://www.quora.com/What-fallacy-is-speculation

- https://www.investopedia.com/terms/d/deceased-account.asp

- https://www.livemint.com/money/personal-finance/5-key-factors-to-check-before-choosing-an-investment-plan-11671806977323.html

- https://springwaterwealth.com/5-key-considerations-before-you-invest/

- https://money.usnews.com/investing/articles/best-cheap-stocks-to-buy-under-10

- https://finance.yahoo.com/news/genius-ways-1-000-month-105500970.html

- https://www.emerald.com/insight/content/doi/10.1108/eb013463/full/pdf

- https://www.quora.com/What-are-the-characteristics-of-a-capital-investment-decision

- https://www.ifec.org.hk/web/en/other-resources/hot-topics/5-investment-concepts.page

- https://byjus.com/question-answer/what-are-the-two-main-sources-of-capital/

- https://corporatefinanceinstitute.com/resources/economics/foreign-investment/

- https://www.investopedia.com/articles/financial-theory/11/corporate-project-valuation-methods.asp

- https://equityandhelp.com/speculative-investing/

- https://en.wikipedia.org/wiki/Benjamin_Graham

- https://www.investopedia.com/should-you-save-your-money-or-invest-it-depends-4692975

- https://www.quora.com/What-are-the-differences-between-investment-or-speculation

- https://www.nerdwallet.com/article/investing/the-best-investments-right-now

- https://www.fidelity.com/learning-center/personal-finance/basics-of-investing-money

- https://estatelawatlanta.com/what-happens-to-my-investments-when-i-die/

- https://cleartax.in/glossary/capital-investment

- https://testbook.com/key-differences/difference-between-speculation-and-investment

- https://public.com/learn/how-to-set-investment-objectives

- https://finance.yahoo.com/news/now-good-time-invest-stock-113000086.html

- https://www.investopedia.com/terms/i/investor.asp