Home

>

Resources

The first-ever growth equity compensation report (with comparison to private equity and VC)

By Mike Hinckley

Expert Bio

Table of Contents

Add a header to begin generating the table of contents

If you’re interested in a career in growth equity, you’re probably wondering what the salary and compensation are like. You may also be wondering whether or not there is a bonus.

In this article, we’ll take a look at the typical salary, compensation, and bonus for growth equity professionals.

Growth equity compensation

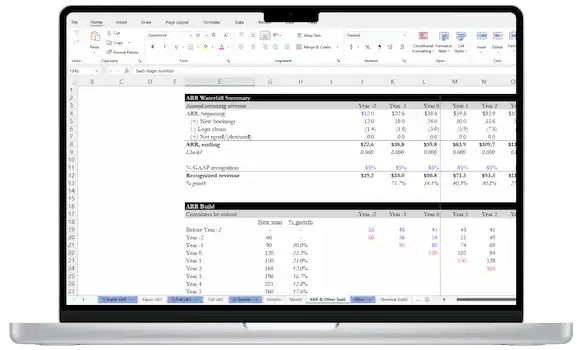

To quantify “typical” compensation by role in growth equity, I’ve completed (to my knowledge) the first-ever study of actual salary data from top growth equity firms.

The table below summarizes my findings:

Study methodology

The salary dataset is based on obscure (but publicly available) Department of Labor filings that firms must make as part of the H1B visa process.

For the study, I included salaries from 2019-2022 to calculate averages. As is typical in the industry, I’ve used 100%-150% of salary as the illustrative cash bonus range to give a picture of typical “total cash compensation”. Compensation from carried interest or co-invest is excluded.

The dataset is much more robust for junior roles (e.g. analyst, associate, and vice president). Data is much more sparse for principal and MD-level roles.

Firms included in the study were: General Atlantic, Summit Partners, TA Associates, Insight Venture Management, Volition, Stripes, JMI Management, Great Hill, Serent Capital, Inconiq, Spectrum Equity, Adams Street, and Sixth Street.

Growth equity salary

In growth equity, firms pay high cash salaries as the base of your compensation.

Our study found the following max-min ranges for salaries at top growth equity firms:

- Analyst: $70k-$160k ($108k average)

- Associate: $90k-$250k ($142k average)

- Vice President:$175k-$325k ($235k average)

- Principal, MD, and above:Limited data, but $250k-$1m anecdotally

Growth equity bonus

Bonuses are typically paid at once annually. They are paid in cash, and at most large growth equity firms, it’s standard that bonuses will range between ~100-150% of your base salary.

Growth equity carried interest

Carried interest, or “carry”, is contingent compensation that accrues to members of the firm based on the performance of its investments. In most cases, carry is reserved for partners or senior investment professionals.

Below is the likelihood of getting carry based on your role:

- Analyst: None

- Associate:None

- Senior Associate:Very rarely given

- Vice Presidents (VP):Small-moderate amounts are likely

- Managing Directors (MD) / Partners:Significant amount

(Article continues below)

- 88 lessons

- 18 video hours

- Excels & templates

STEP-BY-STEP ONLINE COURSE

Everything You Need to Master Growth Equity Interviews

Learn More

Growth equity co-invest

Some firms offer the chance (or requirement) for co-invest. Co-invest is the opportunity to invest your personal capital alongside your firm’s investment in deals.

While not common, when picking firms you should be aware of any requirements for co-investing. I can tell you I know a colleague personally who showed up to his buyside job and was required to write a substantial check ($10,000+) in his first month at the firm!

Don’t let this scare you too much, since this is very uncommon. Also, it’s typically viewed as a perk to be allowed to co-invest in deals, especially if you believe in your firm’s track record.

Growth equity salary vs private equity

Many believe that growth equity compensation, while very strong in absolute terms, is somewhat lower than that at peer private equity or buyout firms.

However, based on the results of my study, one should expect essentially the same level of salary at top growth equity firms as you would at top buyout firms, especially in junior roles (i.e. Analyst and Associate).

Here’s the full comparison:

Note, I regard the figures for Principal and MD-level roles to be essentially unreliable due to low sample size. However, I present them for completeness.

Growth equity salary vs venture capital

Since growth equity firms tend to have larger assets under management than do venture capital firms, they typically have higher salaries and bonuses.

While our study does not directly compare growth equity salaries to those of venture capital, I do expect that there will be a significant difference (with growth equity paying more).

While this relationship wasn’t determinative when comparing large growth equity and buyout/LBO firms, my gut is that it’d be more influential for comparing growth equity with venture.

Given the high risk and (potential for) high returns, venture capital compensation relies much more heavily on returns from carry in most cases.

Factors that impact growth equity compensation

All else equal, growth equity pay tends to be higher with:

- Roles in financial hubs – in the U.S., these include NYC, SF, LA, Boston, and Chicago

- Roles in North America – roles in the U.S. tend to be substantially higher than those in Europe, Asia, and Africa

- Roles with larger firms – funds with higher assets under management tend to pay more

How much do you make in growth equity?

- Growth equity compensation is typically high, with salaries ranging from $70k-$160k for analysts to $250k-$1m for principals and managing directors.

- Bonuses are usually 100-150% of salary, paid in cash.

- Carried interest (or “carry”) is a bonus based on the performance of investments that accrues to partners or senior investment professionals. It is typically given to vice presidents and above.

- Co-investing, or investing personal capital alongside the firm’s investment in deals, may be required or offered as an opportunity at some firms.

- Growth equity compensation tends to be similar to private equity compensation but higher than venture capital compensation.

Next steps

Check out these articles to go deeper on the growth equity industry and career paths within it:

- Growth equity career paths

- Growth equity industry primer

- Top growth equity firms

- Articles in Guide

▾ 📗 Primer: Growth Equity

Growth Equity Investments

Top Growth Equity Firms

Growth Equity vs. Private Equity

Growth Equity vs. VC

Growth Equity Career Path

Growth Equity Hours

- More Guides

▸ Break Into Growth Equity

▸ Break Into Venture Capital

▸ 🚀 Break Into Private Equity

▸ Break Into Investment Banking

▸ 📗 Primer: Private Equity

▸ 📗 Primer: Investment Banking

DIVE DEEPER

The #1 Online Course for Growth Investing Interviews

- 63 lessons

- 13h video

- Templates

- Step-by-step video lessons

- Self-paced with immediate access

- Case studies with Excel examples

- Taught by industry expert

Learn More

Get My Best Tips on Growth Equity Recruiting

Just great content, no spam ever, unsubscribe at any time